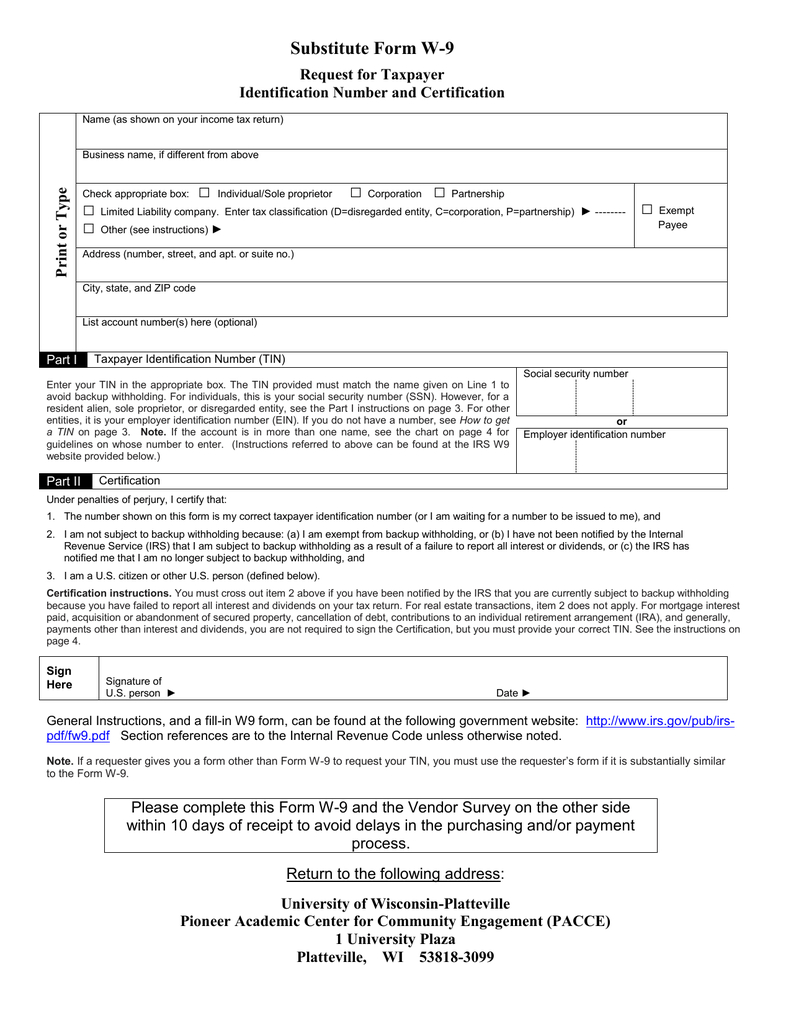

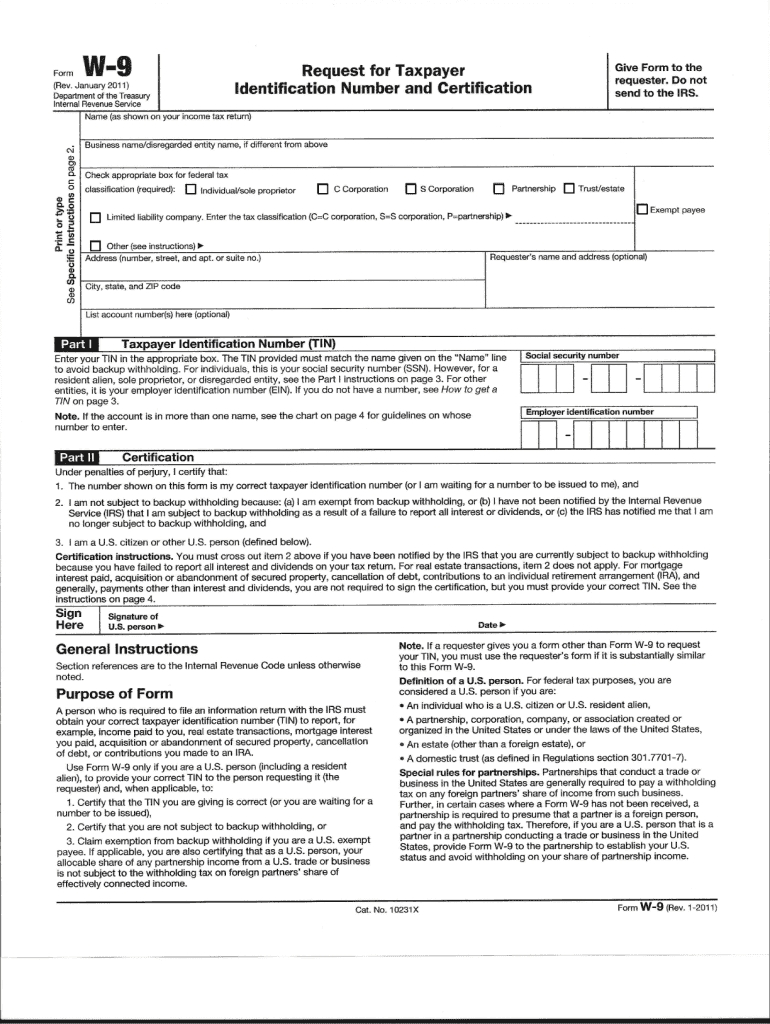

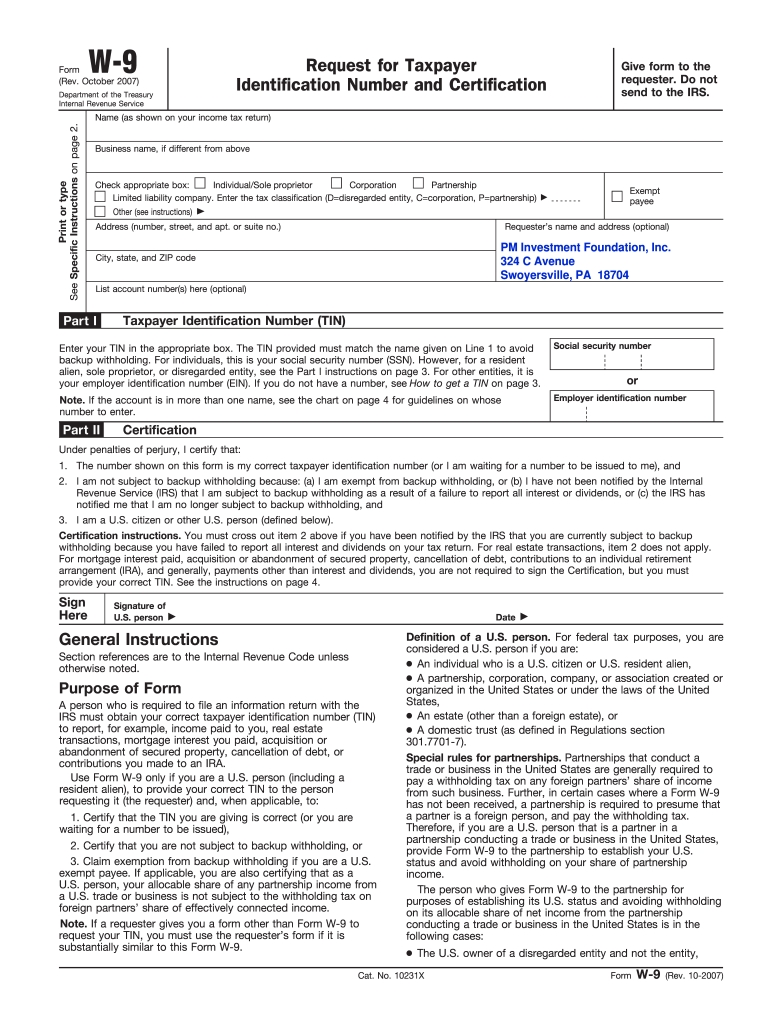

If you ever find yourself filling out a Form W-9, it generally means a business or person who is paying you money needs your U.S. IRS Form W-9 is most commonly used by individuals when they are working as a freelancer or independent contractor. The signer should have the organization’s consent to sign a W-9 on its behalf. The person who signs a W-9 must be a U.S. A TIN may be a social security number (SSN), individual taxpayer identification number (ITIN), adoption taxpayer identification number (ATIN), or employer identification number (EIN/FEIN). The W-9 form is required by an individual or entity (Form W-9 requester) who is required to file an information return with the IRS and must obtain the payee’s correct taxpayer identification number (TIN) to report on an information return the amount paid to a payee, or other amount reportable on an information return.

#Irs w9 form how to

For tax reportable transactions, if a W-9 is not on file per the WISDM Vendor Search and you do not include the W-9 with your payment requests, Business Services will put your payment request on hold and inform you that you need to get a W-9 before the payment is released for processing.ĭownload – How To Use Vendor Search in WISDM for SFS AP Transactions (PDF) How is the W-9 used? If a W-9 is not on file, you will need to include a W-9 with your first payment request to a vendor so the vendor can be set up at Accounting Services and the Taxpayer Identification Number (TIN) can be verified with the IRS TIN Matching Program. If a W-9 is on file, you will not need to include a W-9 with your payment requests. When processing tax reportable payments through any UW payment mechanism please check the WISDM Vendor Search to determine if a W-9 (or W-8 BEN for Nonresident Aliens (NRA)) is on file at Business Services.

An itemized list of donated materials and their value needs to be provided Receipts for materials and services purchased frustrated and surprised there was no disclosure of this info prior. The city may demand the originals even to process labor reimbursement but due to warranties AND because I’m not an employee I am resistant to this as they may also claim all my expenses as theirs…. Is this correct? Do I complete the W9? OR only for our labor/hours and not provide the original receipts as I believe I can put the $6k of landscaping and water drainage work we’ve installed into home improvement. When I asked why, the city gave me a blanket statement from accounting that they needed Ws (which type has not been clarified) We were awarded the grant and now I am being asked for a W9 which concerned me as I purchased the supplies with funds I earned from a job (already taxed as income)

I had the time but needed $ for the pipes, soil, plants, ex.

This year I applied for clean water/rain garden grant.

Very much hoping you can advise as I believe I may get double taxed and my expenses will be written off as someone else’s.

0 kommentar(er)

0 kommentar(er)